ventura property tax due date

The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. DUE DATES - Ventura County.

Ventura County Treasurer Tax Collector Facebook

Learn all about Ventura County real estate tax.

. Once the first installment of taxes on the supplemental bill becomes delinquent no Homeowners. December purchases are always billed for taxes due January 31st of the next year. The Second Installment of Ventura County 2020-21 Secured Property Taxes was due February 1 2021.

Whether you are already a resident or just considering moving to Ventura County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Appeal Deadline March - April. When are Ventura County Property Taxes Due.

Revenue Taxation Codes. Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after December 10 2020 will be assessed a late payment penalty fee of 10. County Treasurer-Tax Collector announced that April 10th deadline for Secured property tax bills is still in effect.

Quarterly filings are required and are due no later than the 20th of the month following the end of the quarter. Property taxes levied for the property tax year are payable in two installments. Or email questions to.

Page updated on February 10 2022 at 1148 AM. Property taxes not paid by December 10 2020 will become delinquent. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties.

For more information. SECURED TAXES ARE DELINQUENT AFTER APRIL 10 2020. Man gets 50 years for enticing molesting girl.

Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after December 10 2020 will be assessed a late payment penalty fee of 10. Secured Property Taxes in Ventura County are paid in two installments. 2020-21 VENTURA COUNTY SECURED PROPERTY TAXES DUE NOVEMBER 1 2020.

SECURED PROPERTY TAX DEADLINES AND TAX COLLECTOR UPDATES FOR COVID-19. Ventura County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property. During this challenging time your patience is.

Single Payment Due Delinquent Date October 15 First Installment Due Delinquent Date June 15 Second Installment Due Delinquent Date August 15 Personal Property Information Assessment Notice Issue Date February - March. For most taxpayers winter taxes are due February 14 while the deadline for summer taxes is September 14. Real Estate Tax Information.

A 25 percent discount is allowed for first-half property taxes paid before September 1 and for second-half property taxes paid. The City of Alexandria levies a tax each calendar year on all real estate located in the City that is subject to taxation. When December 10th or April 10th falls on a Saturday Sunday or legal holiday the delinquency date is the next business day.

The property tax due dates are May 15 for the first and October 15 for the second instalment. Pursuant to the Executive Stay at Home Order by. Rendition Date December 15.

If you purchase in September your due date will be October 30th with a delinquency on November 1. The second installment is due March 1 of the next calendar year. The first installment is due November 1st and is considered late on December 10th while the second installment is due February 1st and considered late on April.

Ventura County 2020-21 Secured Property Taxes were due November 1 2020. New Short Term Rental businesses must return their application for certification within 30 days of the start of business. October purchases must be paid by November 30 while November purchases have a due date of December 31.

The Tax Collector does not have the ability to change or alter the amount to be paid online. If a claim is filed after the 30th day following the date printed on your Notice of Supplemental Assessment but on or before the date on which the first installment of taxes on the supplemental bill becomes delinquent then 80 of the exemption may be allowed. For more information go to.

Again real property taxes are the single largest way Ventura pays for them including more than half of all district school funding. Jorge Renberto Ventura 28 of Marietta was sentenced to 50 years including 30 in prison Thursday afternoon on two. Ventura County 2020-21 Secured Property Taxes are due November 1 2020.

1st Installment is due November 1st delinquent after December 10th. 2nd Installment is due February 1st delinquent after April 10th. All online payments will have penalties if past the delinquency date.

Not just for counties and cities but also down to special-purpose entities as well like sewage treatment stations and athletic parks with all reliant on the real property tax. Tax Payments for Calendar Year 2021. Ventura County property taxes due FRAZIER PARKLOCKWOOD VALLEY Monday November 2 2020 at 130 pm The Ventura County Treasurer-Tax Collector has notified The Mountain Enterprise of its November 1 2020 due date for property taxes.

Taxpayers can pay their taxes in two installments. Ventura County collects on average 059 of a propertys assessed fair market value as property tax. Ventura County property taxes as well as Los Angeles County property taxes and all property taxes due within the state of California are due in two installments.

Pay Your Taxes - Ventura County. Residential and commercial property is assessed at 100 of the estimated fair market value as of January 1 of each year. Transient Occupancy Tax is due on or before the last day of the month covering the amount of tax collected.

The date may vary between counties. The 2nd installment of the 201920 Annual Secured property tax bill is due as. The first installment is due September 1 of the property tax year.

Ventura County Treasurer-Tax Collector Steven Hintz said that neither he nor the Ventura County Board of Supervisors has the power to alter the deadline for the taxes due on secured property. See the press release below. County of Ventura - WebTax - Tax Payment History.

Taxes paid after April 12 2021 will be assessed a late payment penalty fee of 10 plus a 30 cost. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

Supervisor Kelly Long County Treasurer Tax Collector Announces Penalty Waivers After April 10 Ventura Calif Steven Hintz Ventura County S Treasurer Tax Collector Announced Today That Beginning April 11 2020 He Will Accept

Alejandro Murillo Ventura County Property Taxes What You Need To Know Property Taxes Have Not Been Postponded To Local Governments By Any Federal Order For Current Property Owners Property Taxes Are

Pay Property Taxes Online County Of Ventura Papergov

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura County Treasurer Tax Collector Facebook

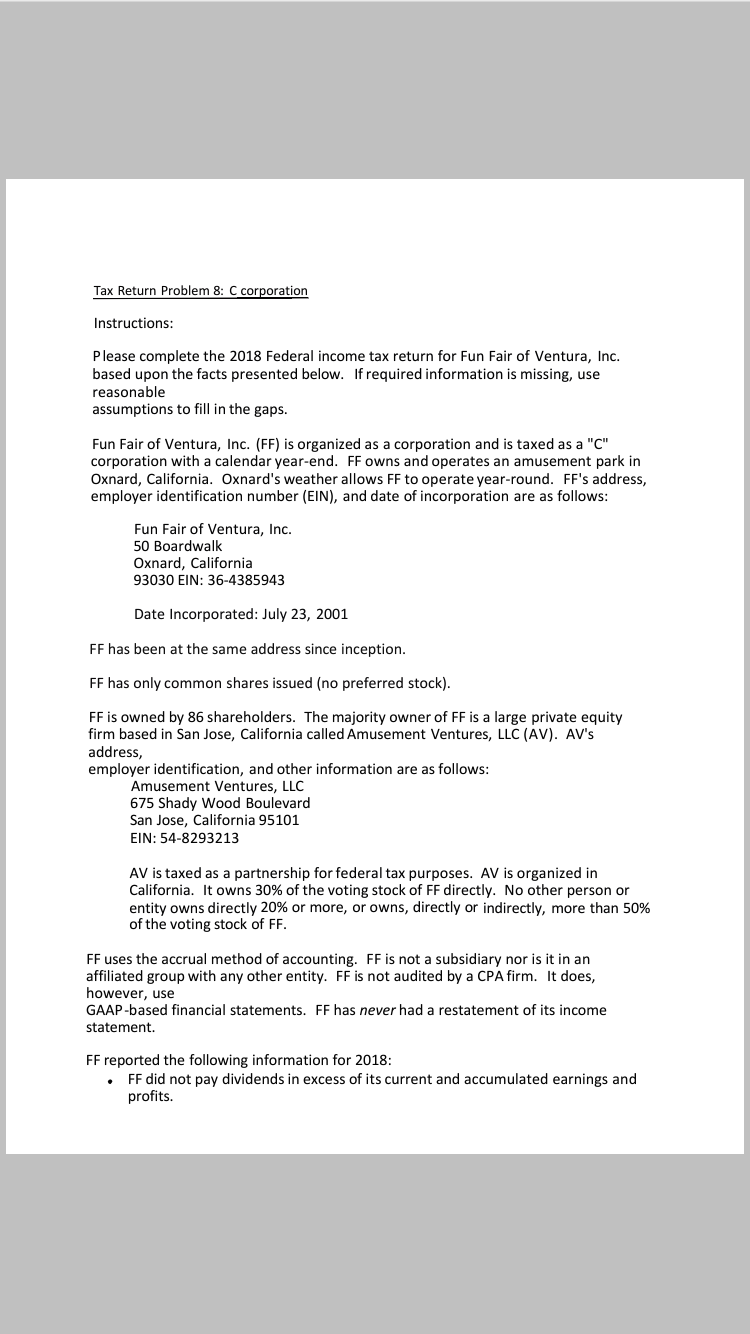

Tax Return Problem 8 C Corporation Instructions Chegg Com

2020 21 Ventura County Secured Property Taxes Due Nov 1 Amigos805 Com

Ventura County Ca Property Tax Search And Records Propertyshark

Covid 19 Coronavirus Emergency Information And Resources City Of Simi Valley Ca

Ventura County Assessor Notification Of Assessment

Ventura County Assessor Supplemental Assessments

Pay Property Taxes Online County Of Ventura Papergov

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021